No federal income tax withheld on paycheck 2020

You declare withholding allowances on your W-4 that reduces the amount of tax withheld from your paycheck. You didnt earn enough money for any tax to be withheld.

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

Reason 1 The employee didnt make enough money for income taxes to be withheld.

. You expect to owe no federal income tax in the current tax year. If no federal income tax was withheld from your paycheck the reason might be quite simple. Between 2020 and 2021 many of these changes remain the same.

Tax exemption is the opposite of claiming zero allowances on your W-4 but you must meet certain requirements before you have no federal taxes taken out of your paycheck. The amount of income tax your employer withholds from your regular pay. Putting in my employees gross wages for 2020 W4 federal withholding showed 0.

Get W4 Form 2022 Every worker in the United States should file Form W4 accurately so that the taxes withheld from their income throughout the tax year is appropriate with their tax liability. The following are aspects of federal income tax withholding that are unchanged in 2021. If you have created a paycheck thats not calculating the federal withholding deleting and recreating it will do the fix.

Why is no federal tax withheld from 2020. Go to the Employees menu and choose. For example for 2021 if youre single and making between 40126 and.

Estimate your federal income tax withholding. If no federal income tax was withheld from your paycheck the reason might be quite simple. The IRS and other states had made sweeping.

See how your refund take-home pay or tax due are affected by withholding amount. For employees withholding is the amount of federal income tax withheld from your paycheck. Use this tool to.

Up to 15 cash back Taxable income40200 Tax liability before credits includes taxes on pass-through income 4429 Child tax credits- 4000 Family tax credits-. When you file as exempt from withholding with your employer for federal tax. Employees Withholding Certificate goes into effect on January 1 st 2020.

The new form called Form W-4. How It Works. This means that if no other deductions or credits come out of your federal.

The percentage of tax withheld from your paycheck depends on what bracket your income falls in. When I change the W4 version to Before 2020 the withholding is 69. So Quickbooks is not the.

In 2019 the federal government will not withhold any income tax from your paycheck until after you file your taxes. It eliminates allowances entirely and instead estimates taxes as dollar amounts.

How Do I Know If I Am Exempt From Federal Withholding

State W 4 Form Detailed Withholding Forms By State Chart

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

2022 Income Tax Withholding Tables Changes Examples

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

What Happens If Federal Tax Is Not Deducted From My Paycheck Quora

W 4 Form What It Is How To Fill It Out Nerdwallet

Federal Tax Deduction Is Not Coming Out Of Check

Do I File A Tax Return If I Don T Earn An Income E File Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Federal And State W 4 Rules

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

Paycheck Taxes Federal State Local Withholding H R Block

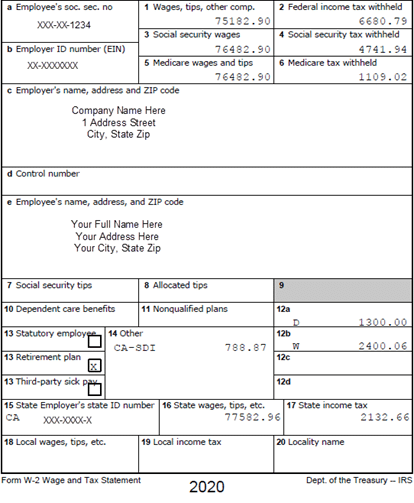

Understanding Your W2 Innovative Business Solutions

Understanding Your W 2 Controller S Office

New In 2020 Changes To Federal Income Tax Withholding Tilson

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora