39+ can you still deduct mortgage interest

Web Homeownership comes with several perks including the ability to deduct the interest you pay on your mortgage. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Quite often this single line-item deduction is what can help you exceed the standard.

. Web This lower cap means that you will not be able to deduct the full amount of interest paid on your mortgage loan if youve purchased a home that requires a mortgage exceeding. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable.

The previous limit was 1. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage. Web The most notable change is that Americans can no longer deduct interest on home equity debt up to 100000.

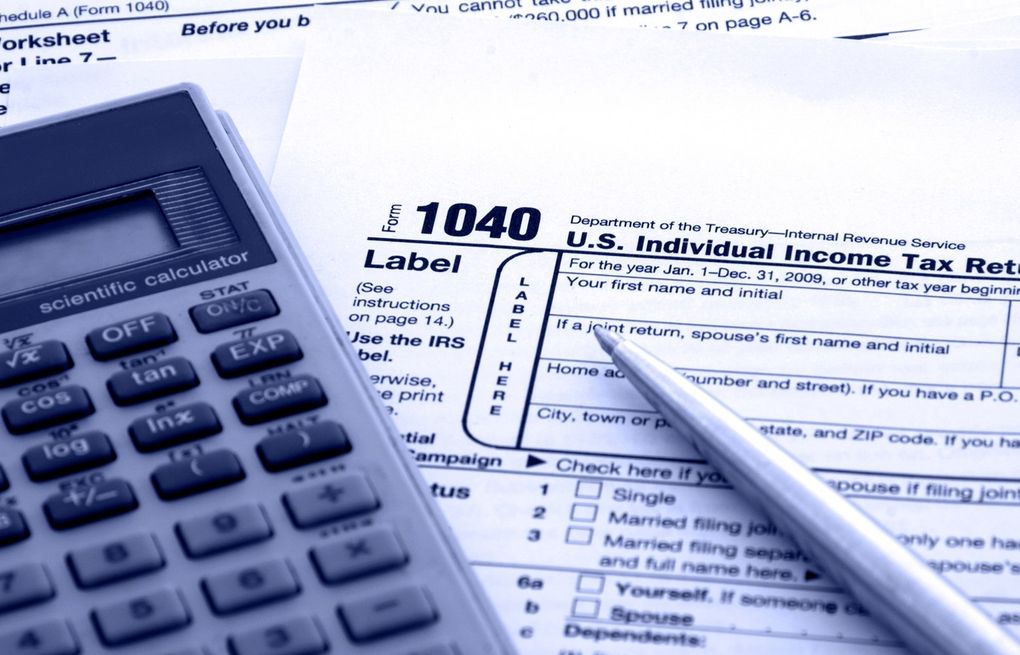

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web For tax years 2018 through 2025 you can only deduct the interest from the amount of your loan that was used to buy build or improve the home that its secured by. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

Web Depending on how big your mortgage is you may encounter a cap on the interest you can deduct. Web Mortgage interest and property taxes you paid while your friend was alive or after your friend died but the house was still in his name are not deductible by you. If your mortgage was in place on December 14 2017 you.

Get The Answers You Need Here. Web The deduction can be claimed only for the interest paid on mortgage debt up to 750000 if the loan was taken out after Dec. Many Americans panicked and believed they couldnt deduct any.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. The home mortgage interest deduction allows. Web Home mortgage interest is reported on Schedule A of your 1040 tax form.

750000 if the loan was finalized after Dec. Web If your home was purchased before Dec.

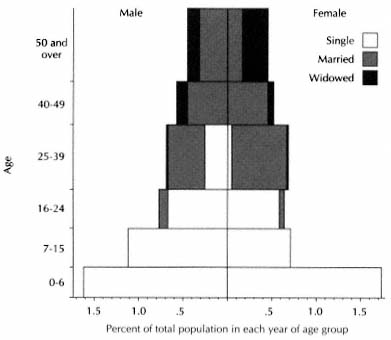

Rural Change And Royal Finances In Spain D0e13063

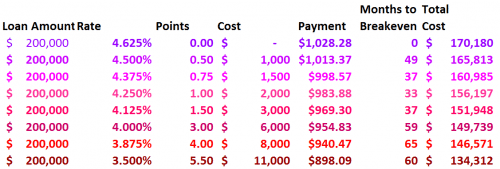

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Save When Filing Your Taxes

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

When Is Mortgage Interest Tax Deductible

Mortgage Interest Deduction What You Need To Know Mortgage Professional

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

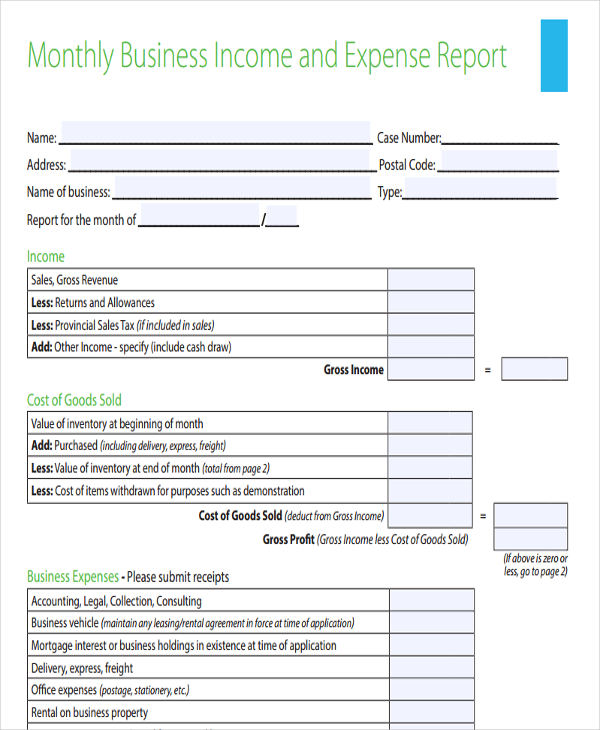

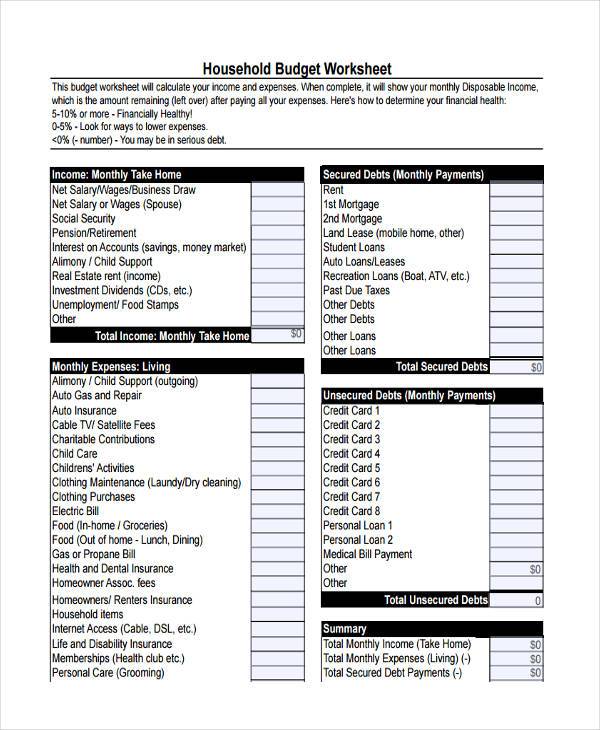

Free 39 Sample Budget Forms In Pdf Excel Ms Word

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

How To Create An Amortization Schedule In An Access Database Quora

Calculating The Home Mortgage Interest Deduction Hmid

5 Ways To Shave 25 Percent Off Your Mortgage Rate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

3 Ways To Calculate Mortgage Interest Wikihow

Real Estate Issue 2022 By Montecito Journal Issuu

Mortgage Interest Tax Deduction 2022 What If You Forget